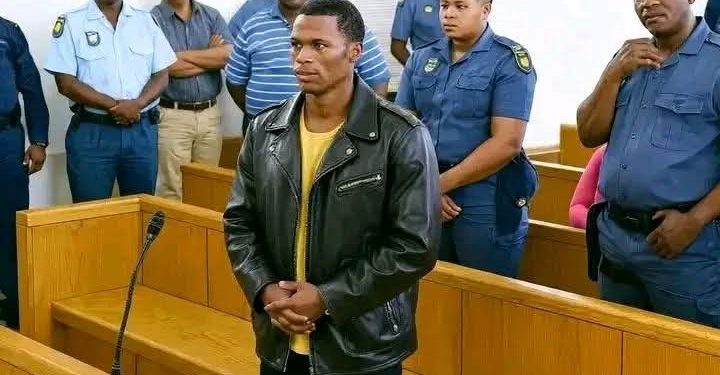

A man who mistakenly received R2.5 million into his bank account has appeared in court after repeatedly refusing to return the funds, despite efforts by the bank and law enforcement to recover the money. The case has reignited debate around accidental payments, personal responsibility, and the legal obligations of recipients of erroneous deposits.

According to court papers, the large sum was deposited into the man’s account in error. Almost immediately after the funds reflected, the money was transferred to another account. When the mistake was detected, the bank attempted to reverse the transaction but was unsuccessful, as the funds had already been moved.

Police were initially unable to locate the man for arrest, further complicating recovery efforts. Once contact was eventually made, authorities instructed him to return the money. However, he allegedly refused, expressing frustration over how the situation was handled. He reportedly told investigators that it would have been “better if the money had been stolen outright,” rather than mistakenly deposited into his account.

Despite repeated requests, the man allegedly remained defiant. Even after spending or transferring a portion of the money, he was asked to return the remaining balance. He reportedly dismissed these demands, telling authorities, “Please take me to court — I will not return it.”

The matter has since escalated to the courts, where the accused continues to resist returning the funds. Prosecutors argue that retaining money that was clearly deposited in error constitutes unlawful appropriation, regardless of whether the initial receipt was accidental. They maintain that once the recipient became aware that the funds were not lawfully his, he had a legal duty to report the error and return the money.

Legal experts note that South African law does not recognise “accidental enrichment” as a defence. Individuals who knowingly keep money paid to them by mistake may face criminal charges, including theft or fraud, depending on the circumstances. Transferring the funds to another account shortly after receiving them may also be viewed as evidence of intent.

The defence has not yet publicly outlined its legal strategy, but the accused’s refusal to cooperate has drawn public attention and criticism. Observers say the case could set an important precedent regarding how courts deal with mistaken electronic transfers in an era of instant banking.

The case has been postponed to allow further legal arguments, while authorities continue efforts to recover the remaining balance. A ruling is expected to clarify whether the accused will be compelled to repay the money and face additional criminal consequences.